As more Australians become increasingly conscious of the shared social responsibility to protect our planet, the demand for green super funds continues to increase.

How do you know if a super fund is truly eco-friendly?

What is a Green Super Fund?

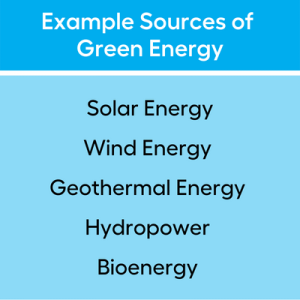

Green super funds invest in businesses with policies and practices addressing greenhouse gas emissions, resulting in environmental benefits and a more sustainable economy.

These investments include businesses engaged in green energy, sustainable resources, conservation, clean transportation, and adaptation to global warming.

Ethical Super Funds in Australia

While the spotlight on green super funds continues to shine, young investors are going one step further by investing their money ethically.

Ethical investments, aka sustainable investments or responsible investing (RI), are becoming popular among workers planning their superannuation funds.

Some Aussies are increasingly interested in investing their retirement savings in businesses that provide solutions to growing environmental and humanitarian issues that affect the future of the planet.

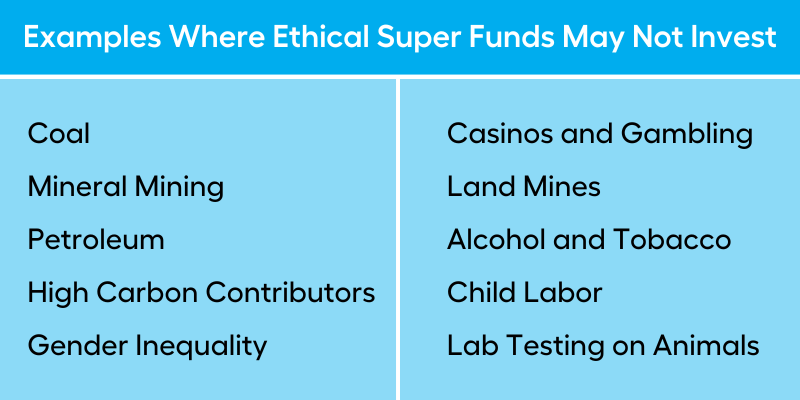

These issues can range from the use of fossil fuels, which has a direct impact on climate change, to animal welfare and controversial weapons.

Australian ethical super funds aim to invest your superannuation contributions in sectors that exercise ethical business practices. Your investment portfolio will not include industries that use fossil fuels, practice child or slave labor, or disregard animal welfare.

Questions to Ask Your Super Fund To Learn How Green It Really Is

There are some key questions you can ask superannuation funds including your existing super account if you want to leverage your superannuation fund to have a positive impact on the environment while ensuring your investments get the best returns.

Does the Super Fund Offer Ethical or Responsible Investment Options?

People have different ideas about what RI or ethical investing means. For most people, the key issues are fossil fuels or uranium, while for others it’s gambling or employee safety.

No standard method is used by super funds to select RI, ethical, and sustainable assets.

You have to read your fund’s investment guide or product disclosure statement if your super fund is aligned with your values. A detailed list of the assets held in each super fund’s investment options are available on their website.

How Does the Super Fund Screen Companies for Ethical Investing?

There are many approaches to RI to ensure that your money ethically funds businesses you trust.

- Negative Screens: This method excludes sectors or industries you don’t want to support. You may opt-out of a super fund that supports tobacco, alcohol, gambling, child labor, animal cruelty, and weapons.

- Positive Screens: Identify and invest in companies that try to make a positive impact on the environment or humanity. These include sectors that deal with sustainable and renewable energy and companies that provide education and healthcare.

- Impact Investing: Identify companies whose business operations revolve around creating solutions for global warming or turning waste into energy. The core mission of these companies is to provide a better world for future generations.

How Much Fees are Involved with Ethical Super Funds?

An ethical super fund invests in a specific sector and it will cost you more in investment fees. This is because putting together those portfolios takes a lot of work and research. Here is where your individual investment objectives limit your investment option and can affect your long term investment earnings.

Which Companies Lead In ESG Initiatives?

The MSCI Australia ESG Index report provides exposure to companies that outperform their sector peers in terms of environmental, social, and governance (ESG).

The MSCI Australia ESG Index consists of large and mid-cap companies in Australian markets, and it aims to offer investors a broad, diversified sustainability benchmark and the selection of companies is based on data from MSCI ESG Research.

What’s the Performance of Responsible Investment Funds?

A 2021 study by the Responsible Investment Association Australasia (RIAA) reports that Funds implementing responsible investment practices continue to outperform their peers.

Although past performance is not a reliable indicator of future fund performance, the report shows that,

responsible investment approaches are in the best financial interests of super funds’ members.

What to Consider When Switching to an Ethical Super?

To switch from your existing super fund to an ethical super fund is easy. You can request your new fund to do this on your behalf.

You can also choose to roll over your super to consolidate your nest egg in one fund. You don’t pay tax on the amount rolled over until you choose to withdraw your super, however switching could have an effect on your insurance benefits, so check before you switch.

Get Your Ethical Super Sorted with Novo Wealth

If you’re all set to invest in ethical funds, it’s worth considering to seek advice. This way your personal preference matches with your financial situation before you make any investment decisions.

With more people advocating for ethical investing, the world may eventually witness a significant change in the environment and society for good. As long as you work with the right ethical financial adviser, you can positively impact the world, advancing us one step closer to achieving all our environmental goals.

We are the ethical financial advice specialist for professionals and business owners who want to invest responsibly, specialising in transitioning our clients from working life into retirement.

Book a FREE 15-minute chat with our friendly team to get started!