Can you really invest ethically without sacrificing returns?

In my work as a financial adviser, this has been one of the biggest concerns with clients who are wanting to invest in line with their ethics, beliefs, and values: but won’t I have to sacrifice returns?

While there is no guarantee of performance with investments, and each person’s experience is unique, there is a lot of supporting evidence to show that on average there is no significant difference in returns between traditional and ethical investing. While most studies tend to show average returns are similar, several studies show that ethical or socially responsible investments actually outperform over the long-term. Yes, you can have your cake and eat it too, and I’m going to show you that making money doesn’t have to come at the cost of people and planet.

The Top 5

Of the 100’s of papers out there, the following are my top 5 that support the investment case for matching your portfolio with your values:

- The Value of Responsible Investment: The moral, financial and economic case for action

- Sustainable Reality: Analyzing Risk and Returns of Sustainable Funds

- ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies

- Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance

- Responsible Investment Benchmark Report: 2020 Australia

Believing that ethical investing means sacrificing your financial future is a common myth.

In a report by Morgan Stanley, a 2017 survey of individual investors found that 75% of respondents are interested in sustainable investing, but 53% of investors surveyed believe that investing sustainably requires a financial trade-off.

Sustainable vs Traditional

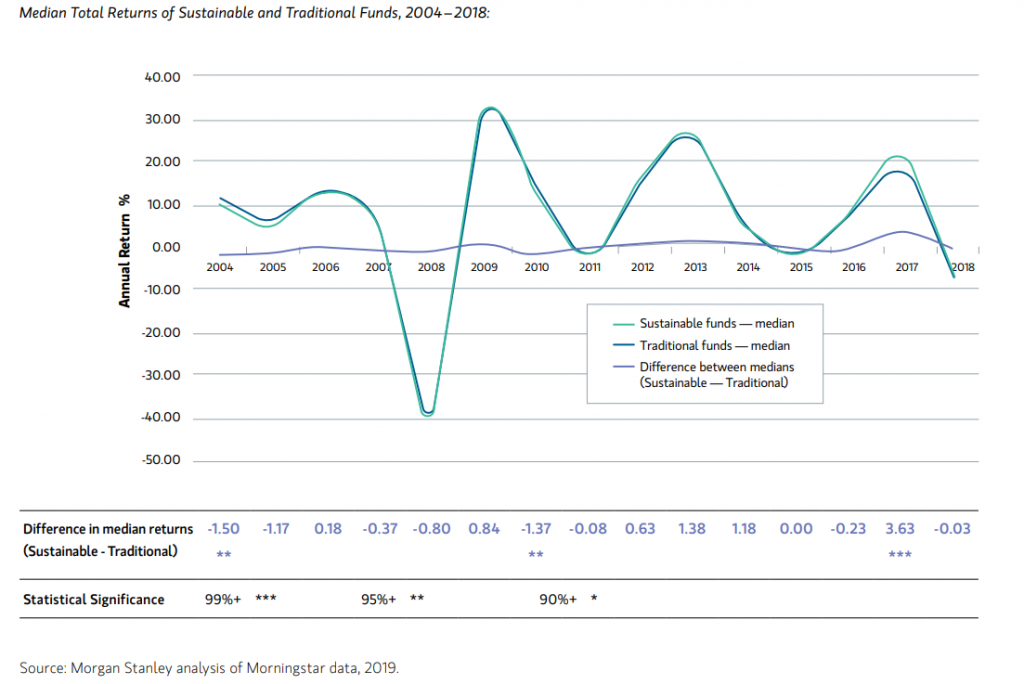

This report then goes to show there is no trade-off in the financial performance of sustainable funds compared with traditional funds. They analysed the returns of 11,000 funds between 2004 and 2018, finding only sporadic and inconsistent differences in performance over this time.

This same study demonstrates that sustainable funds may be less risky than traditional funds. Over the same period, the downside deviation was consistently smaller for the sustainable funds, meaning that sustainable funds may potentially offer downside risk protection to investors.

As with the other reports above, the myth that ethical investing means sacrificing returns has been busted time and time again.

Once we realise that we can use our money to do good in the world and still maintain a financially secure future, the stress and anxiety that prevents us from investing in line with our ethics and beliefs begins to drop away.

I tell all my clients that my role is not simply to help you accumulate wealth for retirement, its to provide you with financial security, and peace of mind that your money is supporting the causes, companies and industries that you feel strongly about.

But sadly, many Australians will be afraid to ask their adviser if they can invest in a way that feels right for them.

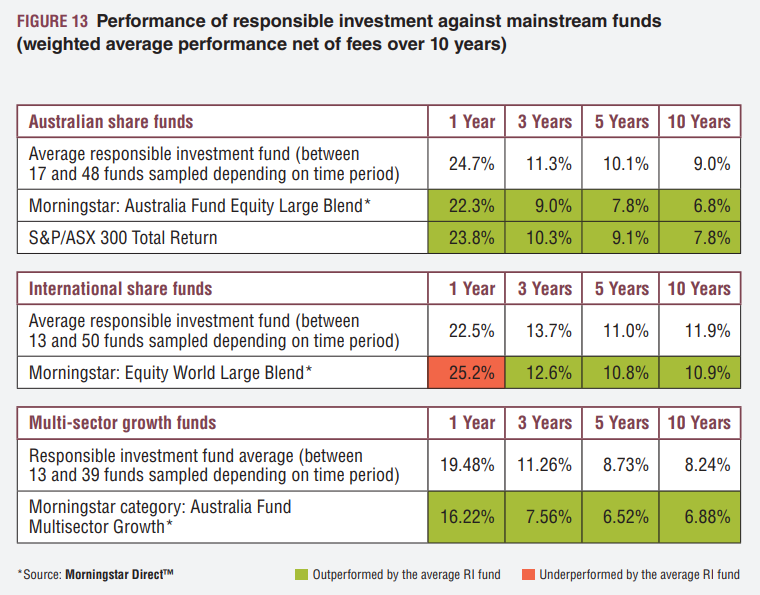

According to research conducted by the Responsible Investment Association of Australasia (RIAA), both Australian and multi-sector responsible investment funds outperformed the mainstream benchmarks for all time periods: 1 year, 3 years, 5 years, and 10 years (refer to chart below). The responsible investment international funds also outperformed in all years except the 1 year time frame.

Translation: you can invest ethically without sacrificing returns.

Performance Comparison

Like to know more?

If you’d like to avoid investing in harmful industries and start supporting companies and issues that mean a lot to you, follow the 3 simple steps I’ve outlined for you below:

- Think about what matters most to you – are there any environmental or social issues that you feel strongly about? For instance, it may be possible to avoid investing in things like animal cruelty, fossil fuels, tobacco or human rights abuses such as modern slavery and child labour. At the same time, your financial adviser can recommend investments that align with issues you wish to support such as education, health care and renewable energy.

- Ask your adviser if you can discuss where your money is going – your adviser wants to make sure your financial future is secure, and all your needs are met. A growing number of advisers are including discussions about a client’s ethical preferences as an important part of getting to know you. The best way to find out if your adviser is familiar with ethical investing is to ask them.

- Pick a report from the list and send it to your financial adviser – is there a report that resonates with you? If you like academic-style reports, pick number three. If statistics are more your thing, go for number five. Personally, I like number one, as it outlines the moral and economic reasons why investing ethically is good for people, planet and profit. Feel free to share any of the reports!

You no longer need to doubt that your money can be invested according to your values.

If you would like to have deep discussions about the issues that matter most to you, remember that the first step is feeling comfortable bringing it up with your financial adviser.

As a specialist in ethical and responsible investing, you can feel confident that I’ll be able to answer your questions. You can relax knowing that I know which investments will be right for you and are in line with your values.

Want to know more?

Speak to me about how responsible funds may work in conjunction with your overall financial plan.

IMPORTANT; This information is general in nature only it does not take into account your individual circumstances. We recommend that you seek professional advice before making any investment decision.

Please call 08 8363 8810 or email pgarner@novowealth.com.au to discuss.

All the best

Paul Garner CFP®

Certified Responsible Investment Financial Adviser

This article was written in collaboration with Paul Garner of Novo Wealth and Alexandra Brown of Invest with Ethics